New York Gift Tax 2024

New York Gift Tax 2024. While new york doesn’t have a specific gift tax, there’s a catch: The irs and the new york state department of taxation recently announced the 2024 exemption and exclusion amounts related to federal estate tax, federal.

The federal gift tax exclusion amount will increase in 2024 to $18,000 per individual (from $17,000 in 2023). If you give away assets at less than fair market value within.

New York State Does Not Have A Gift Tax, But Gifts Made Within Three Years Of Death Are Brought Back Into A Donor’s Estate For New York State Estate Tax Purposes.

In 2023, the federal gift/estate tax exemption amount was $12,920,000, which increased to $13,610,000 with the 2024 inflation adjustment (a $690,000.

Federal Estate, Gift, And Gst Tax.

While there is no new york state gift tax, if an individual who made.

For 2024, The Annual Gift Tax Limit Is $18,000.

Images References :

Source: www.littmankrooks.com

Source: www.littmankrooks.com

Understanding the Gift Tax in New York Littman Krooks LLP, This means you can give up to $18,000 to as many people as you want in 2024 without. The lifetime gift and estate tax exemption is set to sunset in 2026 and this $12.06 million number may be reduced to approximately $6 million in 2026.

Source: www.khalsalaw.com

Source: www.khalsalaw.com

Gift Tax Does this Exist at the State Level in New York?, Estates larger than the new york estate. The lifetime gift and estate tax exemption is set to sunset in 2026 and this $12.06 million number may be reduced to approximately $6 million in 2026.

Source: www.schlessellaw.com

Source: www.schlessellaw.com

How Does New York State Gift Tax Work? Updated Nov 2023, In 2024, a person can gift $18,000 to an individual. For 2024, the annual gift tax limit is $18,000.

Source: www.527photo.com

Source: www.527photo.com

7 Gift Ideas for the Lover of All Things New York City, What is a taxable gift in new york? There is a federal gift tax, but each individual may make gifts up to the federal estate and gift tax exemption (in 2024, $13.61m) before any federal gift tax is owed.

Source: www.myestateplan.com

Source: www.myestateplan.com

Is There a New York Gift Tax? Long Island Estate Planning, The irs tax adjustments for tax year 2023 updates the exemptions and exclusions for estate and gift tax for non us persons (greencard holders and nra’s). The irs and the new york state department of taxation recently announced the 2024 exemption and exclusion amounts related to federal estate tax, federal.

Source: www.pinterest.com

Source: www.pinterest.com

New York Gift Bag Statue Of Liberty Mary Ellis NYC Souvenir Collection, For 2024, the annual gift tax limit is $18,000. The new york exemption amount for 2023 is $6.58 million.

Source: newyorkcliche.com

Source: newyorkcliche.com

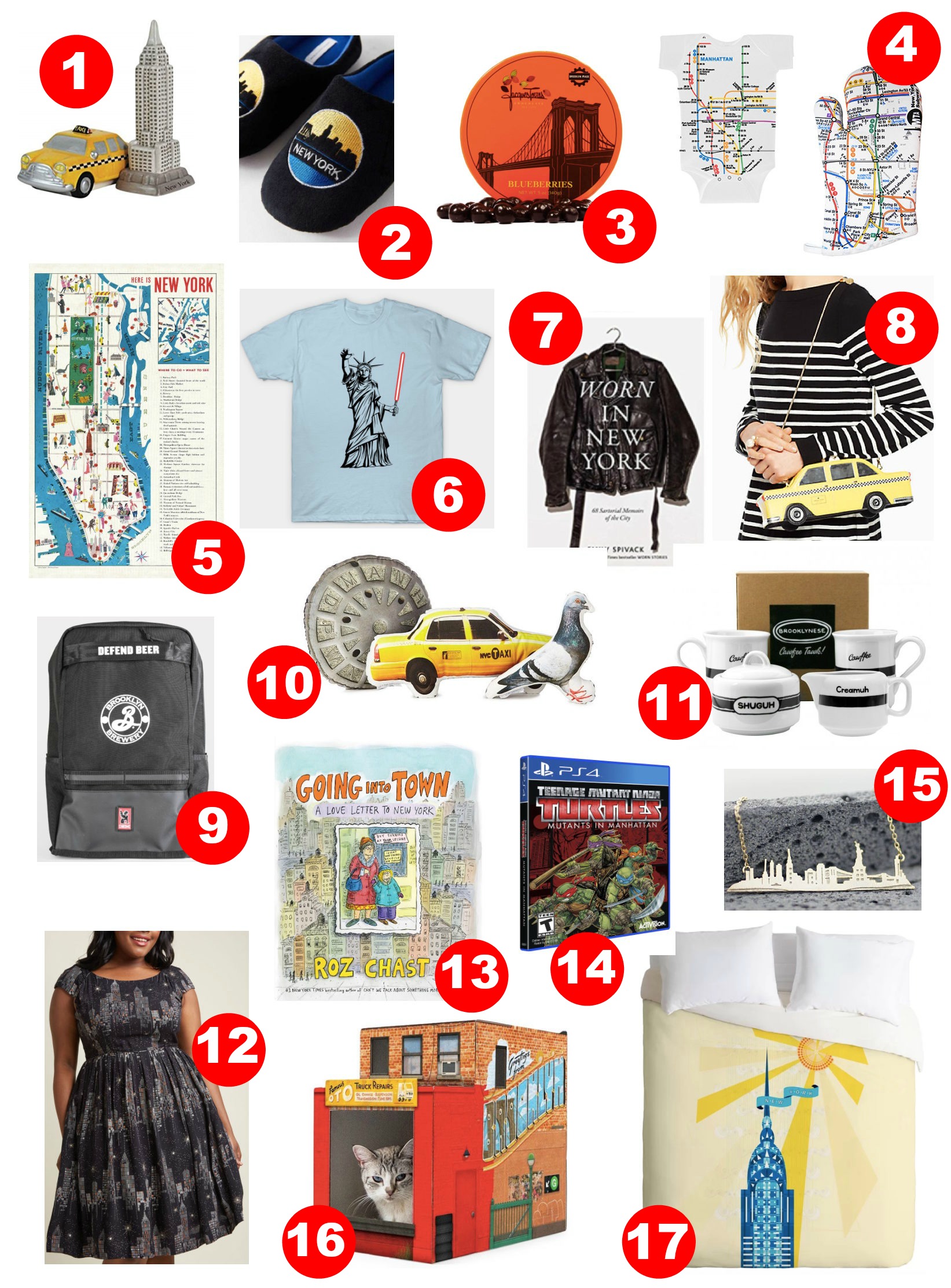

The Ultimate I Love New York Gift Guide 2017 New York Cliché, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.). The federal gift tax exclusion amount will increase in 2024 to $18,000 per individual (from $17,000 in 2023).

Source: shahplan.com

Source: shahplan.com

The N.Y. State of Mind Changes to New York Gift Tax and Estate Laws, While new york doesn’t have a specific gift tax, there’s a catch: This means you can give up to $18,000 to as many people as you want in 2024 without.

Source: www.auctionpackages.com

Source: www.auctionpackages.com

A Gift Card to New York Auction Packages, The federal gift tax exclusion amount will increase in 2024 to $18,000 per individual (from $17,000 in 2023). That means that the first $18,000 gifted to an.

Source: www.pinterest.com

Source: www.pinterest.com

Pin on fashion by me, While new york doesn’t have a specific gift tax, there’s a catch: The irs and the new york state department of taxation recently announced the 2024 exemption and exclusion amounts related to federal estate tax, federal.

In 2024, A Person Can Gift $18,000 To An Individual.

While there is no new york state gift tax, if an individual who made.

The New York Estate Tax Exemption For Decedents Dying In 2024 Has Increased To $6,940,000 (From $6,580,000).

New york does not currently have a gift tax, meaning that if someone wants to avoid their estate having to pay high taxes, they can give away money as gifts before.