Irs Form 941 For 2024 Instructions

Irs Form 941 For 2024 Instructions

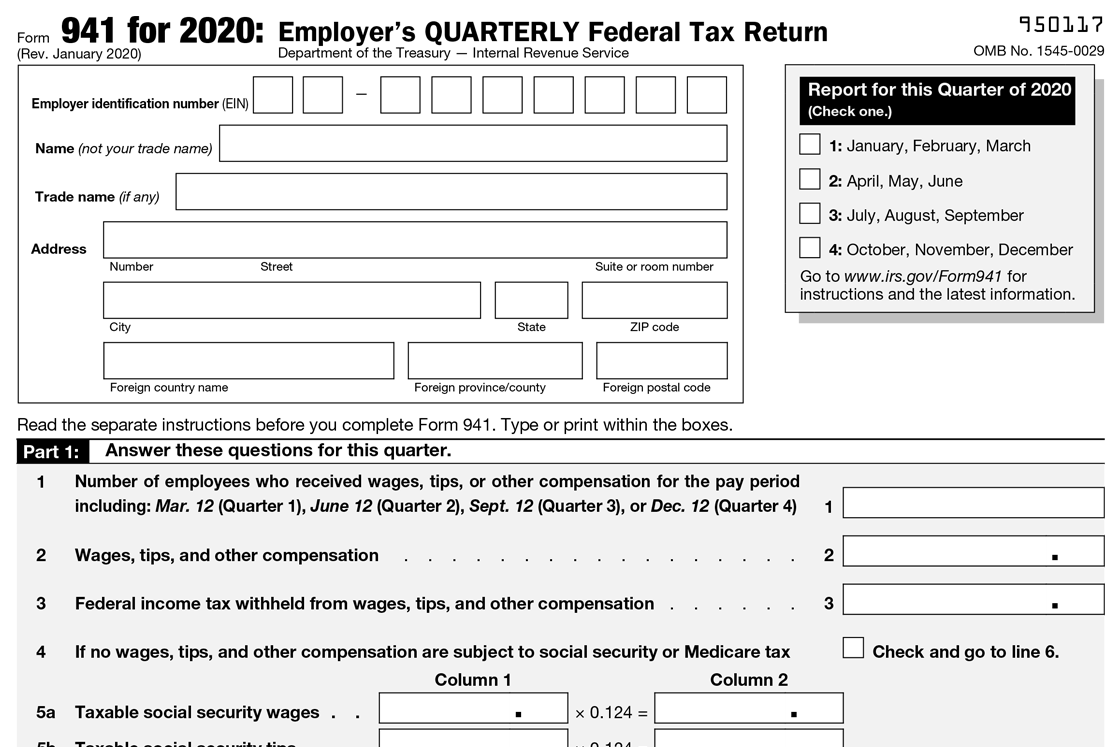

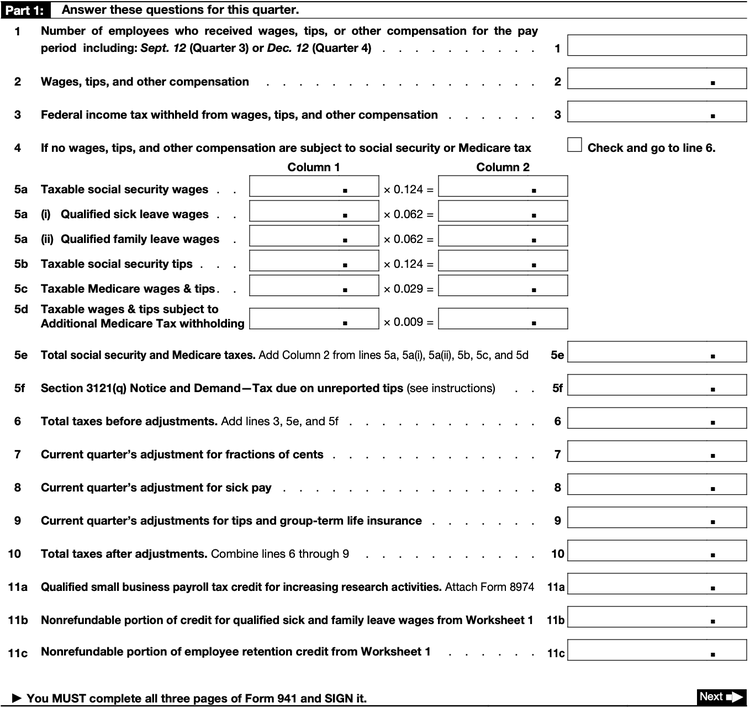

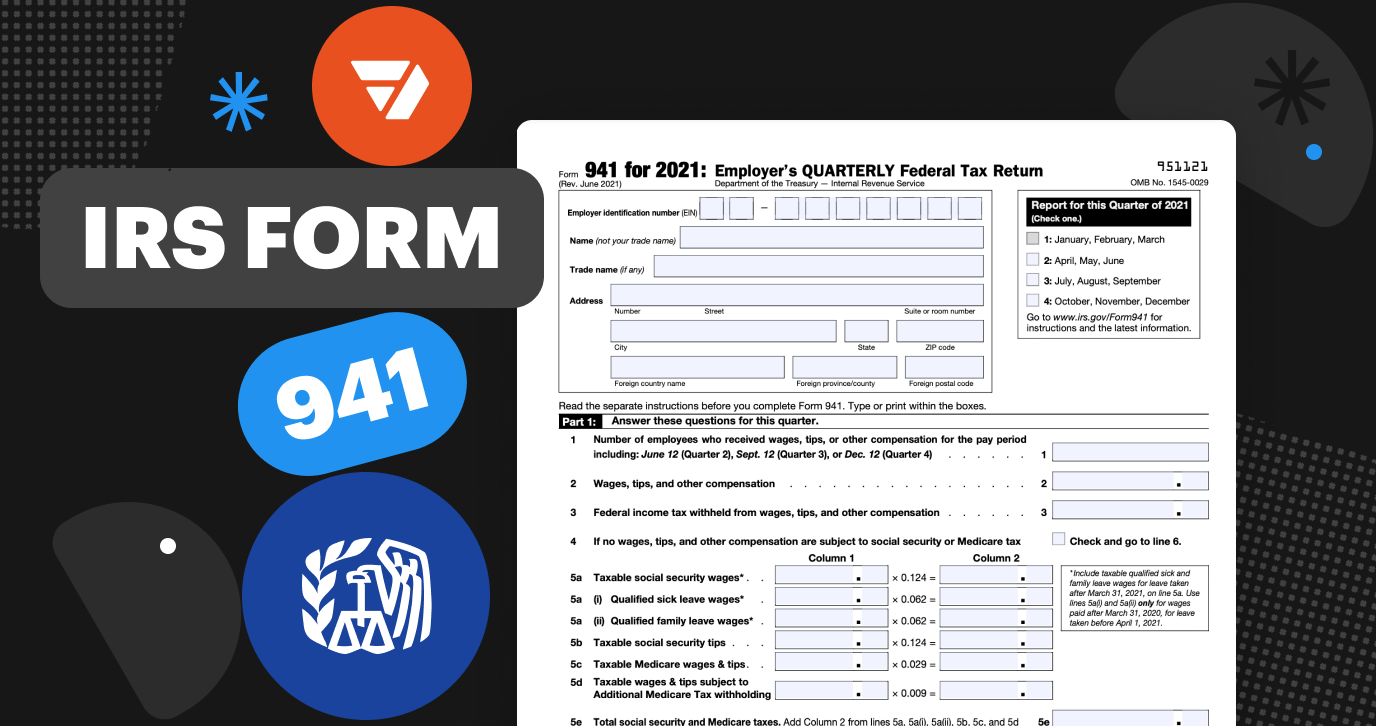

What is irs form 941? Several changes have been made to the 941.

Small business workshops, seminars and meetings, designed to help the small business owner understand and fulfill their federal tax responsibilities, are held at. Draft instructions for form 941 and its schedules to be used for all four quarters of 2024 were released jan.

The Irs Has Released Changes To Form 941 For The 2024 Tax Year.

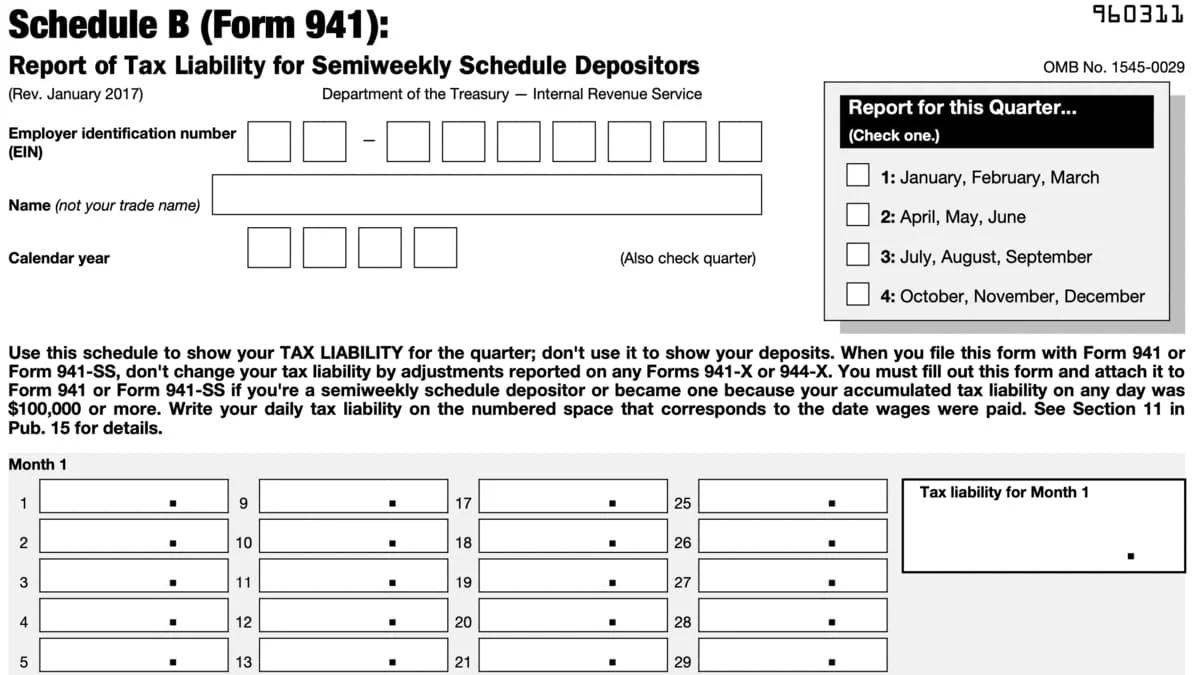

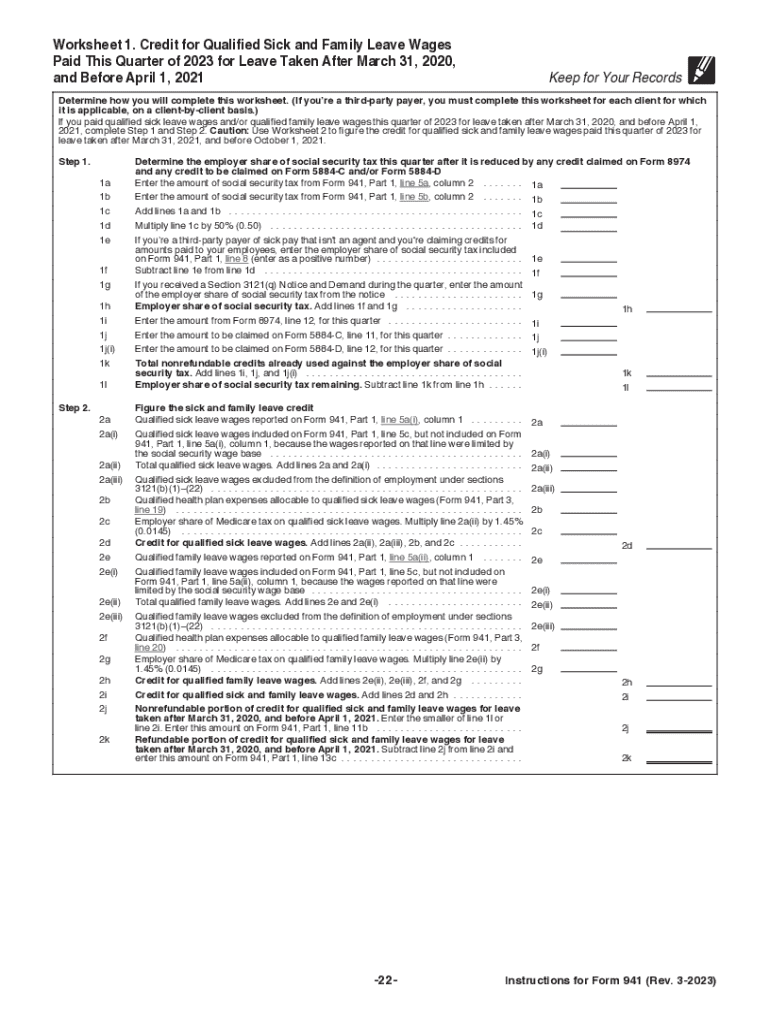

These instructions tell you about schedule b.

Form 941 Reports Federal Income And Fica Taxes Each Quarter.

The irs released the 2024 form 941, employer’s quarterly federal tax return;

Images References :

Source: amelinewjanis.pages.dev

Source: amelinewjanis.pages.dev

Irs Form 941 Instructions 2024 Dot Shelbi, There are a few changes to form 941 that employers should be aware of before filing form 941. Final versions of the quarterly federal.

Source: rozellewaurlie.pages.dev

Source: rozellewaurlie.pages.dev

941 Quarterly Form 2024 Teddy Gennifer, Employers must file irs form 941, employer's quarterly federal tax return, to report the federal income taxes withheld from employees, and employers' part of social security. The irs recently released its 2024 form 941, schedule b, and schedule r along with the accompanying instructions.

Source: nicolettezbrooks.pages.dev

Source: nicolettezbrooks.pages.dev

Irs Form 941 Schedule B 2024 Kore Shaine, Know how to fill out form 941 with irs form 941 instructions for 2024. The irs finalized form 941 and all schedules and instructions for 2024.

Source: www.disasterloanadvisors.com

Source: www.disasterloanadvisors.com

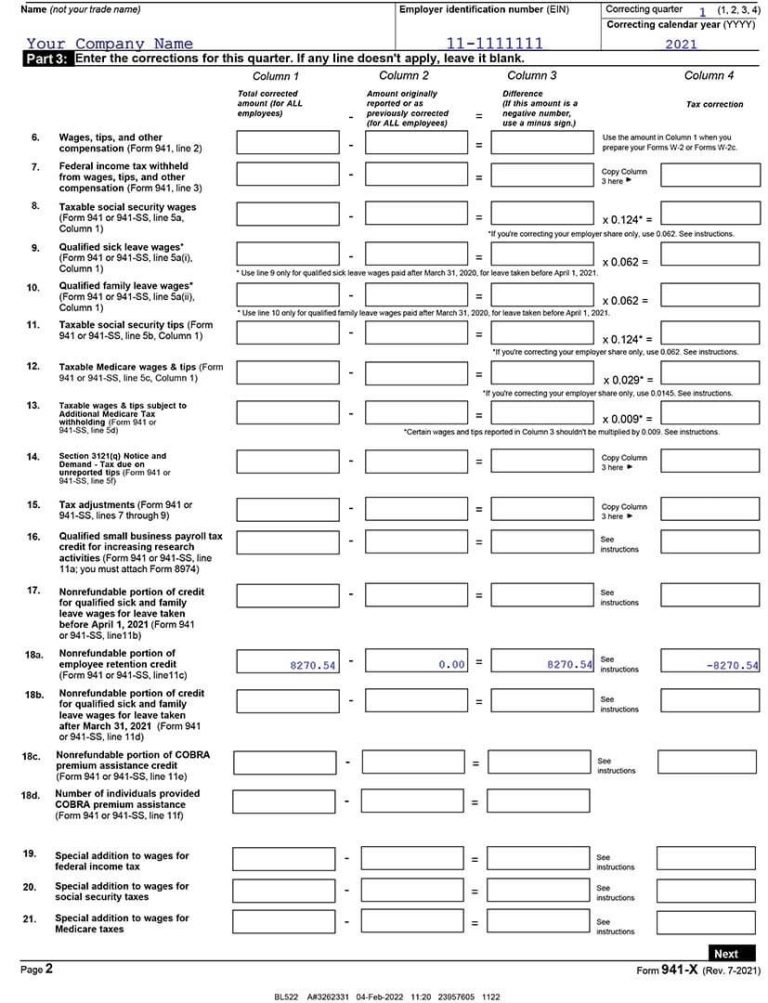

941X 18a. Nonrefundable Portion of Employee Retention Credit, Form, Form 941 reports federal income and fica taxes each quarter. Para solicitar la presentación de los formularios 941 trimestrales para declarar sus impuestos del seguro social y del medicare para el año natural 2024, tiene.

Source: patricawvonni.pages.dev

Source: patricawvonni.pages.dev

When Will Irs Forms For 2024 Be Available Ynes Benedicta, The irs recently released its 2024 form 941, schedule b, and schedule r along with the accompanying instructions. Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from.

Source: albertinawalyce.pages.dev

Source: albertinawalyce.pages.dev

941 Forms 2024 Neysa Adrienne, Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. 23 by the internal revenue service.

Source: 941-instructions.pdffiller.com

Source: 941-instructions.pdffiller.com

2023 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank, The irs finalized form 941 and all schedules and instructions for 2024. The irs has released changes to form 941 for the 2024 tax year.

Source: www.vrogue.co

Source: www.vrogue.co

Irs Form 941 Instructions How To Fill Out Form 941 Fo vrogue.co, What is irs form 941? These instructions tell you about schedule b.

Source: fillableforms.net

Source: fillableforms.net

941 X Worksheet 2 Fillable Form Fillable Form 2024, The irs finalized form 941 and all schedules and instructions for 2024. The irs has released changes to form 941 for the 2024 tax year.

Source: www.disasterloanadvisors.com

Source: www.disasterloanadvisors.com

941X 43. Explain Your Corrections, Form Instructions (revised 2024, This guide provides the basics of the 941 form, instructions to help you fill it out, and where you can get help meeting all your payroll tax obligations. 23 by the internal revenue service.

Final Versions Of The Quarterly Federal.

There are a few changes to form 941 that employers should be aware of before filing form 941.

If You’re An Employer Who Pays Wages And Compensation That Are Subject To Federal Tax Withholding Or Payroll Taxes, Then You May Need To Report Wages And Withheld.

Small business workshops, seminars and meetings, designed to help the small business owner understand and fulfill their federal tax responsibilities, are held at.

Category: 2024